- The U.S. borrows $2.1 billion everyday to pay its debt, and the average American household is carrying more than 9,000 in credit card debt. Today’s so-called middle-class families, with two-working spouses are in worse shape financially—they save less and owe more— than a single-income and middle-class family of 30 years ago (pg 30).

- Real income for the bottom 50 percent of the U.S. populace over the last 25 years has remained relatively flat and the bottom 20 percent has experienced a slight decline. The top one percent experienced a sevenfold increase of income during the same period (pg 31).

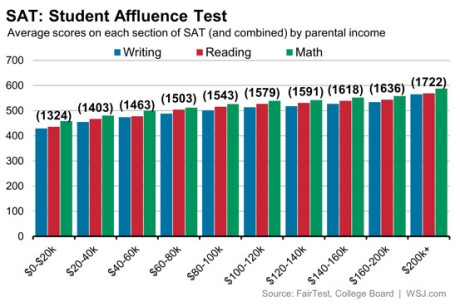

- Tuition at community colleges averaged $2,191 in 2005-06, and they enrolled 46 percent of all undergraduate students attending college. Tuition at private colleges, including room and board, averaged more than 31,000. The community college is becoming the forced-choice among students of moderate-income; nonetheless, their fundraising ability accounts for less than one half of one percent of all private funds donated to colleges. One likely reason is that a class bias exists in the business and philanthropic community helping to perpetuate a two-tier system of higher education (pg 81-82).

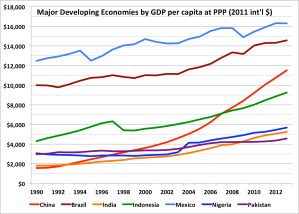

- U.S. production is peaking. China and India each graduate four to one more scientists and engineers than the United States, indicating where tomorrow’s innovation, and inventions will come from: Even worse, there is now reverse “brain drain” from the West to the East, as foreign science/math students graduate from college and leave the U.S. and follow the lure of economic opportunity back to the East (pg 95-96).

- In 1980, the top one percent in the U.S. owned 21 percent of the nation’s wealth. By 2005, they owned 35 percent, equivalent to what the bottom 95 percent owned. In 1980, the same top one percent earned 8.2 percent of the U.S. income; in 2005, they earned 22 percent, equivalent to what the bottom 50 percent (150 million Americans) earned (pg 140).

These facts came from my book Class Counts which you can find here: http://www.allanornsteinbooks.com

Like and comment what you think which is the most interesting (or eye-opening) figure.

There have been a few studies of the students that fall to either side of this line over the years. One such

There have been a few studies of the students that fall to either side of this line over the years. One such

![Women working in a Chinese factory. By Robert Scoble [CC BY 2.0 (http://creativecommons.org/licenses/by/2.0)], via Wikimedia Commons](https://excellencevsequality.files.wordpress.com/2015/04/seagate_wuxi_china_factory_tour.jpg?w=297&h=446)

![The graph shows the rise of the Gini coefficient, which correlates with the rise in inequality. -Photo By Wushi-En [GFDL (http://www.gnu.org/copyleft/fdl.html), CC-BY-SA-3.0, via Wikimedia Commons]](https://excellencevsequality.files.wordpress.com/2015/04/the_us_gini_coefficient_for_household_income_1967_-_2007_1.png?w=418&h=302)

![By United States Department of State (Official Photo at Department of State page) [Public domain], via Wikimedia Commons](https://excellencevsequality.files.wordpress.com/2015/04/512px-hillary_clinton_official_secretary_of_state_portrait_crop.jpg?w=240&h=300)

![By US Senate (Email from the Office of Senator Marco Rubio) [Public domain], via Wikimedia Commons](https://excellencevsequality.files.wordpress.com/2015/04/512px-marco_rubio_official_portrait_112th_congress.jpg?w=237&h=300)